Which are the best insurance awards to enter?

Which are the best insurance awards to enter?

Chris Robinson

Founder & MD, Boost Awards

Which insurance awards should you enter?

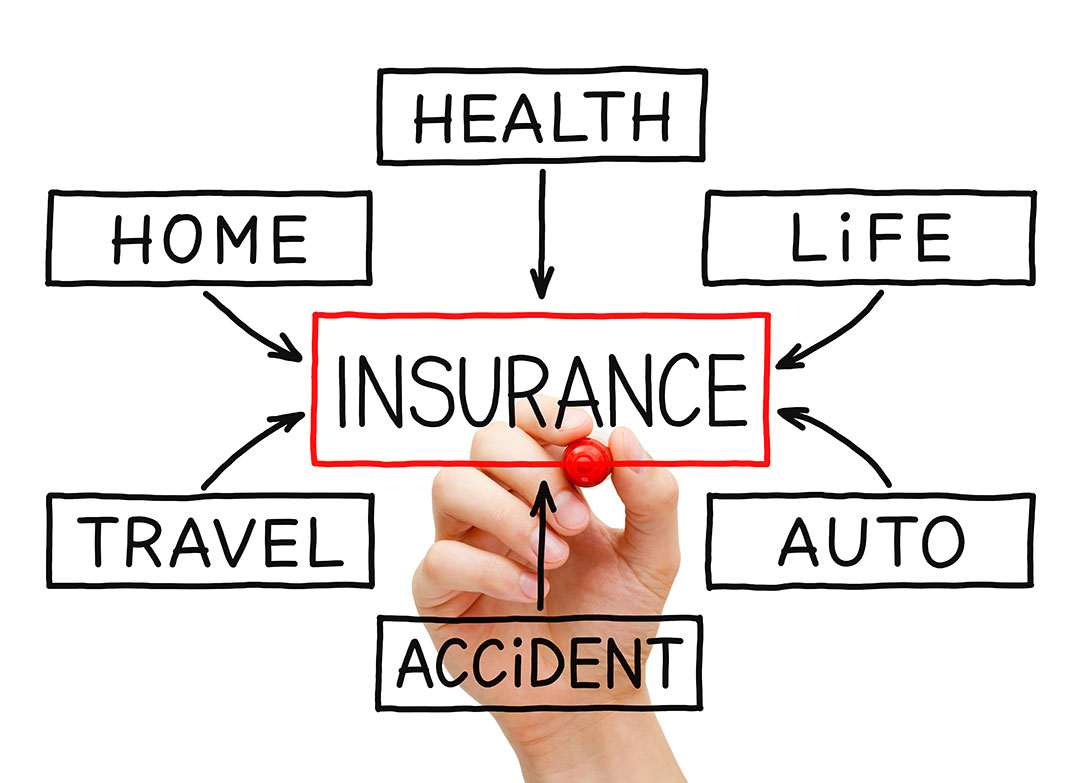

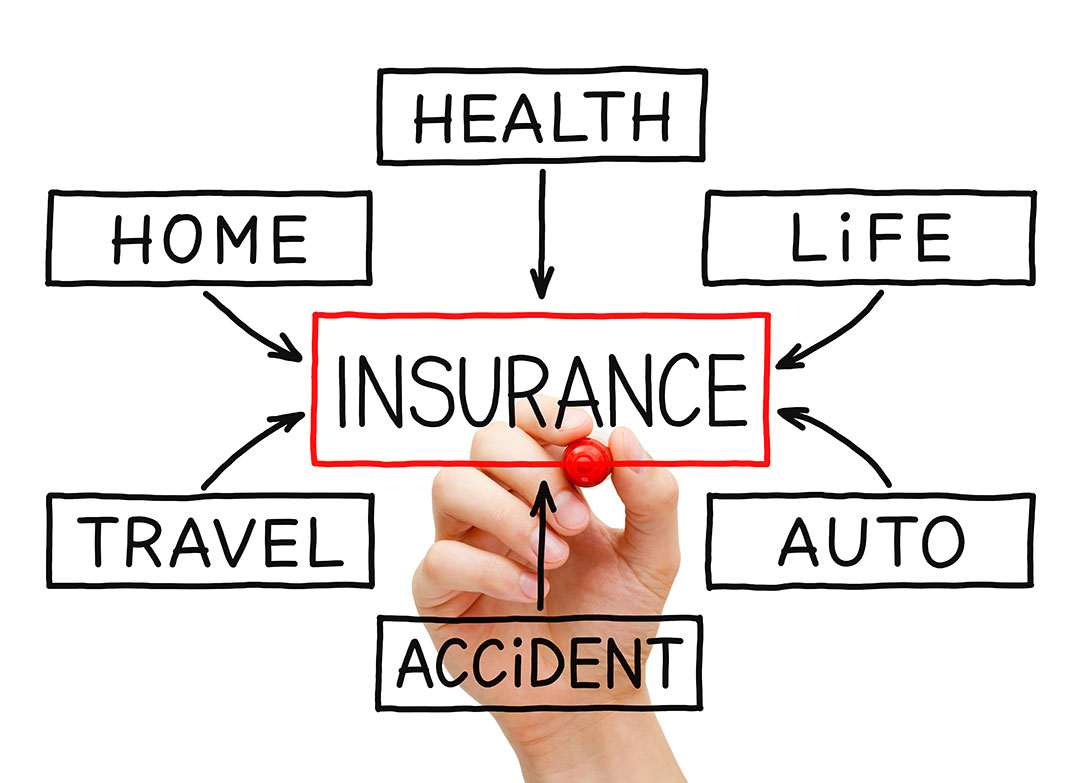

If you work in, or supply to, the insurance sector, then the good news is there is a fantastic choice of insurance awards to enter – and we’re not just talking about the most famous, like The British Insurance Awards and The Insurance Times Awards. However, with this choice comes a challenge – unless you have an unlimited budget, you’re going to have to be choosy. This article will help you pick which insurance awards to enter, and if you still aren’t sure which awards to choose or need help writing your entries, then please contact us and we can discuss ways of increasing your chances of winning.

Before we list the specific awards, I first just want to clarify just why the insurance sector loves awards so much. We ran some consumer research in partnership with Fly Research – the findings revealed that 79% of consumers would be influenced by a relevant award win when choosing between similarly priced insurers. In a sector that’s hard to stand out in for anything other than price, entering insurance awards is a comparatively inexpensive way of getting noticed.

This helps to explain why there are so many awards for insurers to choose from. In fact, in our database of over 5,000 awards, there are no less than 137 awards schemes which have categories for insurance providers. These fall into five camps, which we will cover in the article.

The best of the UK insurance industry awards

Our database of financial services industry awards is simply huge, but it does cover banking, mortgages, investment, lending, pensions, employee benefits, and of course, insurance. Of all these, insurance has the most – 27 award schemes just for this one industry. Is it any wonder insurers have to be picky? They could wipe out their entire budget on just their own industry awards.

- Whole industry awards: The three most highly sought-after awards are The British Insurance Awards (March deadline), British Insurance Technology Awards (April deadline) and The Insurance Times Awards (September deadline).

- Claims awards: The next tier down are the awards for the claims process where the two big ones are The Claims & Fraud Awards (Insurance Post) with their June deadline, and the Insurance Times Claims Excellence Awards (March deadline).

- Focused insurance awards: Then there are the awards just for the more niche players or individuals: for example The UK Broker Awards (March deadline), and The Women in Insurance Awards (April deadline).

Financial service awards (not specific to insurance)

The number of insurance industry awards is eclipsed by a vast array of financial services awards. Most of these are specific to one sub-sector or another, such as those listed earlier (mortgages, pensions etc.), but there are a few schemes which are more open. 34 of these have insurance-specific categories, of which our favourites are:

- Two Moneyfacts schemes: Very credible, but you cannot submit an entry into them: The Investment Life and Pensions Moneyfacts Awards is a scheme which you cannot officially enter (financial advisor voting process ends April) and The Moneyfacts Awards (February deadline for testimonials).

- The Financial Services Forum FSF Marketing Effectiveness Awards: An extremely popular scheme for the marketing functions within financial services, and we’ve seen many insurers enter – and win – these (June deadline).

- City A M Awards: A scheme aimed at central London businesses (March deadline).

- Chartered Institute of Credit Management (CICM) British Credit Awards (September deadline).

“We ran some consumer research…the findings revealed that 79% of consumers would be influenced by a relevant award win when choosing between similarly priced insurers. In a sector that’s hard to stand out in for anything other than price, entering insurance awards is a comparatively inexpensive way of getting noticed.”

Awards for insurance departments/disciplines

First of all, let’s look at the departmental awards specific to insurance, where the names speak for themselves:

- Insurance Times Tech and Innovation Awards (June deadline).

- The Insurance Post Claims & Fraud Awards (June deadline).

- Insurance Times Claims Excellence Awards (March deadline)

- British Claims Awards (March deadline)

Now let’s look at our favourite departmental awards, which specifically name check insurance:

- For the IT department: The FStech Awards, an EMEA-wide scheme for all forms of financial technology (November deadline) and the World’s Digital Insurance Awards (April deadline).

- For the HR department: The Stevie Awards for Great Employers, an international scheme based in the USA (July deadline).

- For the website team: The eCommerce Awards (June deadline).

- For the customer service department: There is the UK Customer Experience Awards (June deadline) and the more contact-centre focused CCA Excellence Awards run by the Customer Contact Association (November deadline).

Finally, here are the awards for corporate social responsibility:

- Global Good Finance Awards is a highly ethical awards programme bringing finance and sustainability together (May deadline).

- The Sustainability Awards is an international scheme based in the USA and run by Business Intelligence Group (July deadline).

- Green Apple Awards For Environmental Best Practice – these are a very popular, international, multi-winner scheme, more like an accreditation than an award (July deadline).

- World’s Most Ethical Companies is another international scheme involving a complex methodology and their Ethics Quotient® propriety rating system (November deadline).

This isn’t to say that you shouldn’t go for a cross-industry award scheme, but for the benefit of focus, we zoomed in on schemes which explicitly cater for the insurance sector.

Awards for other industry sectors

For every insurance-specific award scheme there is an award scheme for a non-insurance, non-financial industry, which has a category for an insurance provider to this industry. There are 23 schemes like this within our database, with four industries being particularly welcoming to insurance entrants:

The legal sector does like to reach out to the insurance sector, with four schemes offering insurance categories:

- The Legal 500 Awards UK (February deadline).

- Personal Injury Awards (September deadline).

- Chambers UK Bar Awards (no entry process – based on 12 months of research).

- Legal Business Awards (November deadline).

Then there’s property and construction, which includes two schemes:

- National LIS Awards (September deadline).

- Property Management Awards (September deadline).

Then one for healthcare:

- The General Practice Awards (June deadline).

And three for travel and transport:

- What Van? Awards (September deadline).

- British Travel Awards (May deadline).

- Globe Travel Awards (September deadline).

General business awards

We have identified 16 insurance-specific categories of general business awards. Three schemes are particularly popular:

- The International Business Awards (The International Stevies), a very popular US-based scheme with well over 100 categories, so you can re-purpose your submission and enter it multiple times (July deadline).

- Big Awards for Business (Business Intelligence), a US-based international scheme (August deadline).

- The British Business Awards, which celebrate the leaders in the small business community (May deadline).

As you can see, there are plenty of options for gaining recognition for excellence within the insurance sector. I hope you have found this article a useful starting point for awards to consider, but should you need help planning which awards to enter, or indeed need help writing your award entries, I strongly recommend using Boost’s team of award entry experts. As the world’s first and largest award entry consultancy, we have helped our clients, including some of the biggest names in the UK Insurance industry, win over 2,000 awards.

I have personally helped companies enter and win many of the awards outlined above. I would be happy to give you a call to help you double check your chances of success and explain our pricing options. You can contact Boost via our contact form or email me directly via chris.robinson@boost-awards.co.uk

I look forward to hearing from you.

Chris.

Next steps and further research

- Subscribe to receive our free monthly financial services Award Deadline Reminders to your inbox.

- Contact Boost to see how we can help you pick the right awards and maximise your chances of winning.

- Check out our list of UK financial services awards – the largest available anywhere.

- Alternatively – think global and visit our international financial services awards list.

- Which customer service awards should you enter?

- Which HR awards should you enter?

- Which training awards should you enter?

Chris Robinson

Founder & MD, Boost Awards

Which insurance awards should you enter?

If you work in, or supply to, the insurance sector, then the good news is there is a fantastic choice of insurance awards to enter – and we’re not just talking about the most famous, like The British Insurance Awards and The Insurance Times Awards. However, with this choice comes a challenge – unless you have an unlimited budget, you’re going to have to be choosy. This article will help you pick which insurance awards to enter, and if you still aren’t sure which awards to choose or need help writing your entries, then please contact us and we can discuss ways of increasing your chances of winning.

Before we list the specific awards, I first just want to clarify just why the insurance sector loves awards so much. We ran some consumer research in partnership with Fly Research – the findings revealed that 79% of consumers would be influenced by a relevant award win when choosing between similarly priced insurers. In a sector that’s hard to stand out in for anything other than price, entering insurance awards is a comparatively inexpensive way of getting noticed.

This helps to explain why there are so many awards for insurers to choose from. In fact, in our database of over 4,000 awards, there are no less than 137 awards schemes which have categories for insurance providers. These fall into five camps, which we will cover in the article.

The best of the UK insurance industry awards

Our database of financial services industry awards is simply huge, but it does cover banking, mortgages, investment, lending, pensions, employee benefits, and of course, insurance. Of all these, insurance has the most – 27 award schemes just for this one industry. Is it any wonder insurers have to be picky? They could wipe out their entire budget on just their own industry awards.

- Whole industry awards: The three most highly sought-after awards are The British Insurance Awards (March deadline), British Insurance Technology Awards (April deadline) and The Insurance Times Awards (September deadline).

- Claims awards: The next tier down are the awards for the claims process where the two big ones are The Claims & Fraud Awards (Insurance Post) with their June deadline, and the Insurance Times Claims Excellence Awards (March deadline).

- Focused insurance awards: Then there are the awards just for the more niche players or individuals: for example The UK Broker Awards (March deadline), and The Women in Insurance Awards (April deadline).

Financial service awards (not specific to insurance)

The number of insurance industry awards is eclipsed by a vast array of financial services awards. Most of these are specific to one sub-sector or another, such as those listed earlier (mortgages, pensions etc.), but there are a few schemes which are more open. 34 of these have insurance-specific categories, of which our favourites are:

- Two Moneyfacts schemes: Very credible, but you cannot submit an entry into them: The Investment Life and Pensions Moneyfacts Awards is a scheme which you cannot officially enter (financial advisor voting process ends April) and The Moneyfacts Awards (February deadline for testimonials).

- The Financial Services Forum FSF Marketing Effectiveness Awards: An extremely popular scheme for the marketing functions within financial services, and we’ve seen many insurers enter – and win – these (June deadline).

- City A M Awards: A scheme aimed at central London businesses (March deadline).

- Chartered Institute of Credit Management (CICM) British Credit Awards (September deadline).

Awards for insurance departments/disciplines

First of all, let’s look at the departmental awards specific to insurance, where the names speak for themselves:

- Insurance Times Tech and Innovation Awards (June deadline).

- The Insurance Post Claims & Fraud Awards (June deadline).

- Insurance Times Claims Excellence Awards (March deadline)

- British Claims Awards (March deadline)

Now let’s look at our favourite departmental awards, which specifically name check insurance:

- For the IT department: The FStech Awards, an EMEA-wide scheme for all forms of financial technology (November deadline) and the World’s Digital Insurance Awards (April deadline).

- For the HR department: The Stevie Awards for Great Employers, an international scheme based in the USA (July deadline).

- For the website team: The eCommerce Awards (June deadline).

- For the customer service department: There is the UK Customer Experience Awards (June deadline) and the more contact-centre focused CCA Excellence Awards run by the Customer Contact Association (November deadline).

Finally, here are the awards for corporate social responsibility:

- Global Good Finance Awards is a highly ethical awards programme bringing finance and sustainability together (May deadline).

- The Sustainability Awards is an international scheme based in the USA and run by Business Intelligence Group (July deadline).

- Green Apple Awards For Environmental Best Practice – these are a very popular, international, multi-winner scheme, more like an accreditation than an award (July deadline).

- World’s Most Ethical Companies is another international scheme involving a complex methodology and their Ethics Quotient® propriety rating system (November deadline).

This isn’t to say that you shouldn’t go for a cross-industry award scheme, but for the benefit of focus, we zoomed in on schemes which explicitly cater for the insurance sector.

“The truth is simple – it is a sector increasingly hard to differentiate in for anything other than price. Some consumer research…discovered that 79% of consumers would be influenced by a relevant award win when choosing between similarly priced insurers. So there is a comparatively inexpensive way to differentiate your offering after all – insurance awards.”

Awards for other industry sectors

For every insurance-specific award scheme there is an award scheme for a non-insurance, non-financial industry, which has a category for an insurance provider to this industry. There are 23 schemes like this within our database, with four industries being particularly welcoming to insurance entrants:

The legal sector does like to reach out to the insurance sector, with four schemes offering insurance categories:

- The Legal 500 Awards UK (February deadline).

- Personal Injury Awards (September deadline).

- Chambers UK Bar Awards (no entry process – based on 12 months of research).

- Legal Business Awards (November deadline).

Then there’s property and construction, which includes two schemes:

- National LIS Awards (September deadline).

- Property Management Awards (September deadline).

Then one for healthcare:

- The General Practice Awards (June deadline).

And three for travel and transport:

- What Van? Awards (September deadline).

- British Travel Awards (May deadline).

- Globe Travel Awards (September deadline).

General business awards

We have identified 16 insurance-specific categories of general business awards. Three schemes are particularly popular:

- The International Business Awards (The International Stevies), a very popular US-based scheme with well over 100 categories, so you can re-purpose your submission and enter it multiple times (July deadline).

- Big Awards for Business (Business Intelligence), a US-based international scheme (August deadline).

- The British Business Awards, which celebrate the leaders in the small business community (May deadline).

As you can see, there are plenty of options for gaining recognition for excellence within the insurance sector. I hope you have found this article a useful starting point for awards to consider, but should you need help planning which awards to enter, or indeed need help writing your award entries, I strongly recommend using Boost’s team of award entry experts. As the world’s first and largest award entry consultancy, we have helped our clients, including some of the biggest names in the UK Insurance industry, win over 2,000 awards.

I have personally helped companies enter and win many of the awards outlined above. I would be happy to give you a call to help you double check your chances of success and explain our pricing options. You can contact Boost via our contact form or email me directly via chris.robinson@boost-awards.co.uk

I look forward to hearing from you.

Chris.

Next steps and further research

- Subscribe to receive our free monthly financial services Award Deadline Reminders to your inbox.

- Contact Boost to see how we can help you pick the right awards and maximise your chances of winning.

- Check out our list of UK financial services awards – the largest available anywhere.

- Alternatively – think global and visit our international financial services awards list.

- Which customer service awards should you enter?

- Which HR awards should you enter?

- Which training awards should you enter?

Boost – a helping hand entering awards

Boost Awards is the world’s first and largest award entry consultancy, having helped clients – from SMEs to Multinationals – win over 2,000 credible business awards, including most of the customer service award schemes listed. Increase your chances of success significantly – call Boost on +44(0)1273 258703 today for a no-obligation chat about awards.

(C) This article was written by Chris Robinson and is the intellectual property of award entry consultants Boost Awards

Awards List

Please take a look on our UK Awards List and International Awards List websites, where you can find many more customer service awards and awards for contact centres (amongst thousands of others, covering all areas of business).

Boost – a helping hand entering awards

Boost Awards is the world’s first and largest award entry consultancy, having helped clients, from SMEs to Multinationals, win over 2,000 credible business awards, including most of the customer service award schemes listed. Increase your chances of success significantly – call Boost on +44(0)1273 258703 today for a no-obligation chat about awards.

(C) This article was written by Chris Robinson and is the intellectual property of award entry consultants Boost Awards

Awards List

Please take a look on our UK Awards List and International Awards List websites where you can find many more employer-related awards (amongst thousands of others covering all areas of business).

Looking for awards to enter?

Sign up for our free email deadline reminders to make sure you never miss an awards deadline.

Every month you will receive a comprehensive list of upcoming awards deadlines (in the next two months) organised by industry sector.